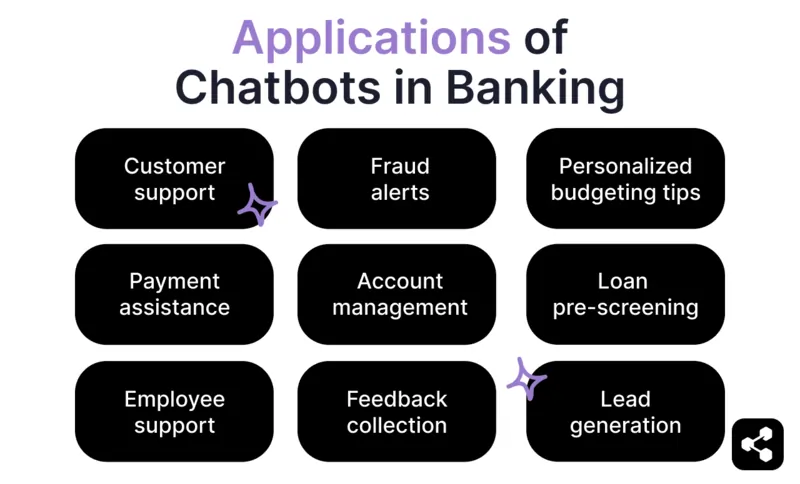

- Banking chatbots are AI tools that use natural language processing to handle tasks such as customer inquiries, transaction assistance, fraud alerts, and account management in real time.

- They are increasingly used for applications like personalized budgeting tips, loan pre-screening, lead generation, and internal support for bank employees, helping financial institutions operate more efficiently.

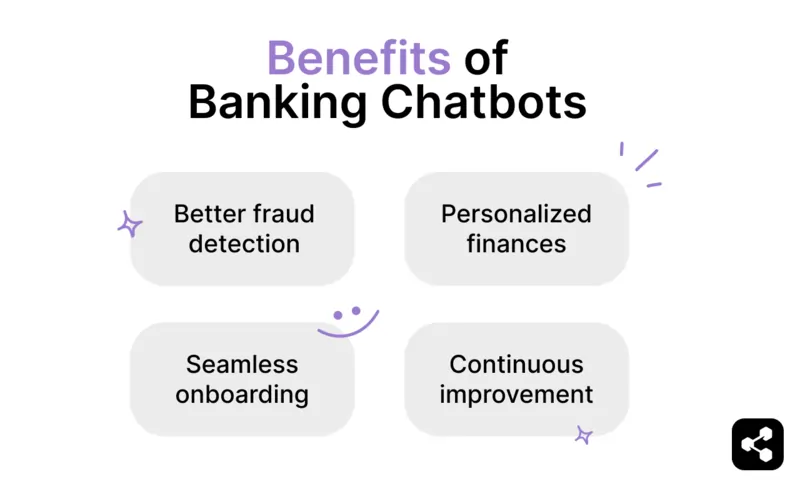

- Benefits of banking chatbots include improved fraud detection, personalized financial guidance, streamlined onboarding, and systems that continuously learn from user interactions to improve performance.

- Implementing a banking chatbot requires clear objectives, a secure and compliant AI platform, integration with essential banking systems, rigorous testing, and ongoing monitoring to ensure reliability and regulatory compliance.

AI chatbots are everywhere these days – and as they become more robust and secure, they’re rising in popularity in industries like banking, finance, and insurance.

Long gone are the days of back-and-forth loops. Today, LLM agents can:

- Provide personalized upselling

- Assist employees through analysis and information retrieval

- Process payments

- Open accounts

- Troubleshoot customer issues

From insurance chatbots to IT chatbots, the banking industry is fundamentally changing how it communicates, scales, and services clients.

We’ve been deploying chatbots for several years – we know a thing or two about best practice. So let’s dive into the ins and outs of banking chatbots.

What are banking chatbots?

AI-powered banking chatbots use natural language processing to understand and respond to customer queries in real time. They handle tasks such as answering account inquiries, processing transactions, and guiding users through banking services.

Applications of Chatbots in Banking

Customer Support

The obvious one: chatbots are an easy way to provide instant answers to common queries – like account balances, transaction history, and branch hours.

The best banking chatbots use RAG, so that they can access real-time information from a bank’s knowledge bases.

Fraud Alerts

Chatbots excel at processing vast amounts of data and communicating changes. They can notify users of unusual activity by monitoring account transactions for suspicious patterns and sending real-time alerts.

As a follow-up step, they can guide customers to secure their accounts, such as freezing cards or changing passwords.

Personalized Budgeting Tips

Instead of direct investment advice, chatbots analyze spending habits and offer general budgeting suggestions or reminders.

For example, they can identify high spending categories and recommend saving strategies. Someone who spends a lot on delivery services in the evening might be prompted to consider a pre-made meal kit delivery instead.

Payment and Transaction Assistance

Chatbots facilitate bill payments or transfers by securely verifying user identity and processing requests through the bank’s transaction systems. They can also set up recurring payments with user authorization.

Account Management

For all the small tasks that clients need help with, there’s a chatbot that can take it on.

Chatbots can assist users in updating account details, such as changing contact information or setting up notifications. They guide customers through the steps required for these updates – always ensuring security protocols are followed.

Loan Pre-Screening

Chatbots help customers check loan eligibility by gathering basic information like income and credit history.

They can also explain loan products and guide users to complete application forms.

Internal Employee Support

For banking staff, chatbots streamline internal processes by answering HR-related questions, providing IT troubleshooting, or helping locate policies in internal knowledge bases. This frees up human resources to do what they do best, instead of menial tasks.

Customer Feedback Collection

Chatbots conduct quick surveys or solicit feedback at the end of interactions by asking specific, user-friendly questions. This easy feature of a customer support chatbot helps banks measure customer satisfaction and identify areas for improvement.

Lead Generation

Chatbots engage potential customers on banking websites or apps by answering initial queries about products like credit cards or mortgages.

They gather contact details and qualify leads for follow-up by sales teams. A lead generation chatbot is one of the most common tools for developing an AI-enhanced sales funnel.

Examples of Banking Chatbots

The best finance chatbots are specific, thorough, and clear in their communications. They solve a gap with well-placed AI, and they're accessible to users via websites or messaging apps.

Here are a few of our favorite banking chatbots carrying out real-world financial tasks.

Bank of America’s Erica

The most widely-known finance chatbot, the Bank of America’s Erica, was a pioneer in the space.

A giant in the field, the bot has racked up over 2 billion interactions since its launch in 2018 – and BofA’s data science team has made more than 50,000 updates to Erica’s performance to finetune its success.

Erica’s most common tasks include: monitoring subscriptions, spending behavior guidance, deposit information, finding account or routing numbers and assistance with transfers and bill payments.

“Erica acts as both a personal concierge and mission control for our clients,” said Nikki Katz, Head of Digital at Bank of America. “Erica meets clients where they are and when they need us, and has become a true guide by their side.”

HDFC Bank’s Eva

India’s first AI banking chatbot, HDFC Bank’s chatbot Eva is transforming rural banking.

Launched on CSC’s Digital Seva Portal, Eva supports over 127,000 Village Level Entrepreneurs (VLEs), providing critical banking services to last-mile customers in semi-urban and rural India.

Eva empowers VLEs with 24/7 access to accurate information on products, processes, and training materials. It helps streamline services like account openings, loan lead generation, and customer support, while also preparing VLEs for certification as Business Correspondents (BCs).

American Express’ Amex Bot

The Amex Bot for Facebook Messenger helps Card Members manage their accounts. Users can:

- Ask for real-time updates on their balance

- Check Membership Rewards points

- Review pending charges instantly

- Link their card to Facebook for payments

- Be transferred to customer support when needed

The Amex Bot is a perfect example of a channel-specific finance chatbot – it turns Messenger into a powerful financial tool, offering Card Members easy insights and access to their account information.

Mastercard’s Decision Intelligence

Mastercard’s Decision Intelligence Pro uses generative AI to transform fraud detection. How?

By analyzing one trillion data points in under 50 milliseconds, it evaluates connections between accounts, merchants, and devices to assess transaction risk.

Their advanced system improves fraud detection rates by up to 300% while reducing false positives by more than 85%.

Decision Intelligence shows that AI systems aren’t just for client-facing conversations – they can help banks analyze data, optimize transaction approvals, and enhance security.

Benefits of Banking Chatbots

1. Better fraud detection

Chatbots can integrate with fraud detection systems to provide real-time alerts and assistance.

They analyze customer behavior, flag unusual transactions, and prompt users to confirm or report suspicious activity.

2. Hyper-personalized financial insights

By analyzing a customer’s transaction history and financial behavior, chatbots can provide tailored advice, such as budgeting tips, savings opportunities, or investment suggestions.

For example, if a customer frequently purchases coffee, the chatbot might recommend a credit card with cashback rewards for dining and cafes.

3. Seamless onboarding

Chatbots streamline the onboarding process by guiding users through document uploads, account setup, and FAQs.

They can provide instant answers, ensure compliance with KYC (Know Your Customer) requirements, and make the experience smooth and user-friendly.

4. Adaptive learning = continuous improvement

Banking chatbots often employ AI that learns from customer interactions. Over time, they refine responses, adapt to new banking products, and become better at predicting user needs.

A chatbot might learn that customers frequently inquire about savings account benefits – then begin to proactively suggest personalized savings plans.

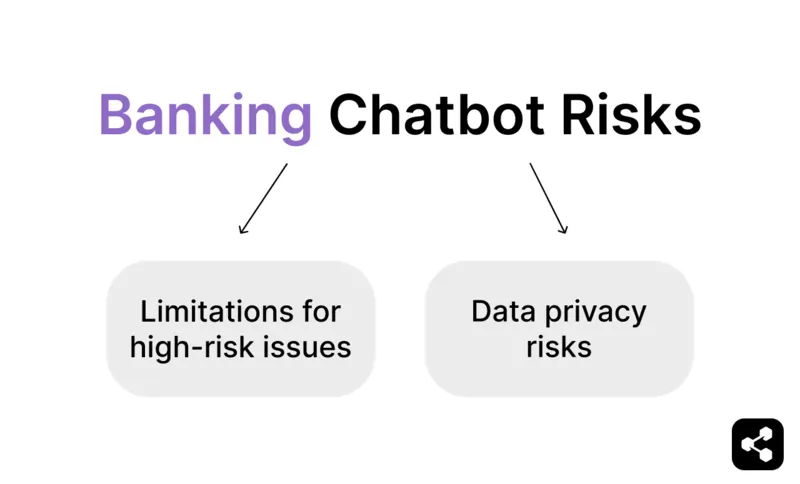

Risks of Chatbots in Banking

Limitations for high-risk issues

While AI systems can carry out plenty of tasks, human oversight is still a necessity for high-risk activities. These can include loan approvals, fraud investigations, or large-scale fund transfers.

AI can be used to assist employees in their tasks, but it’s no replacement for the human judgement needed for high-level tasks.

Data privacy risks

To mitigate data security risks, banks must use chatbot platforms with robust data encryption and compliance with privacy regulations – like being GDPR compliant and SOC 2 certified.

Features and processes like regular security audits and role-based access controls are also vital to the incorporation of AI to high-risk fields. Your team should have the tools for total transparency over all your chatbot’s actions and decisions, and protocols that inspect them regularly.

Employees will also need training on proper use of AI tools – when it’s appropriate to use them to assist in decision-making, how they work, and other human-machine interactions.

Many of our clients find it particularly helpful to have a dedicated Customer Success team – our CSM team guides clients through necessary compliance steps, ensuring secure data handling practices throughout building, deploying, and monitoring.

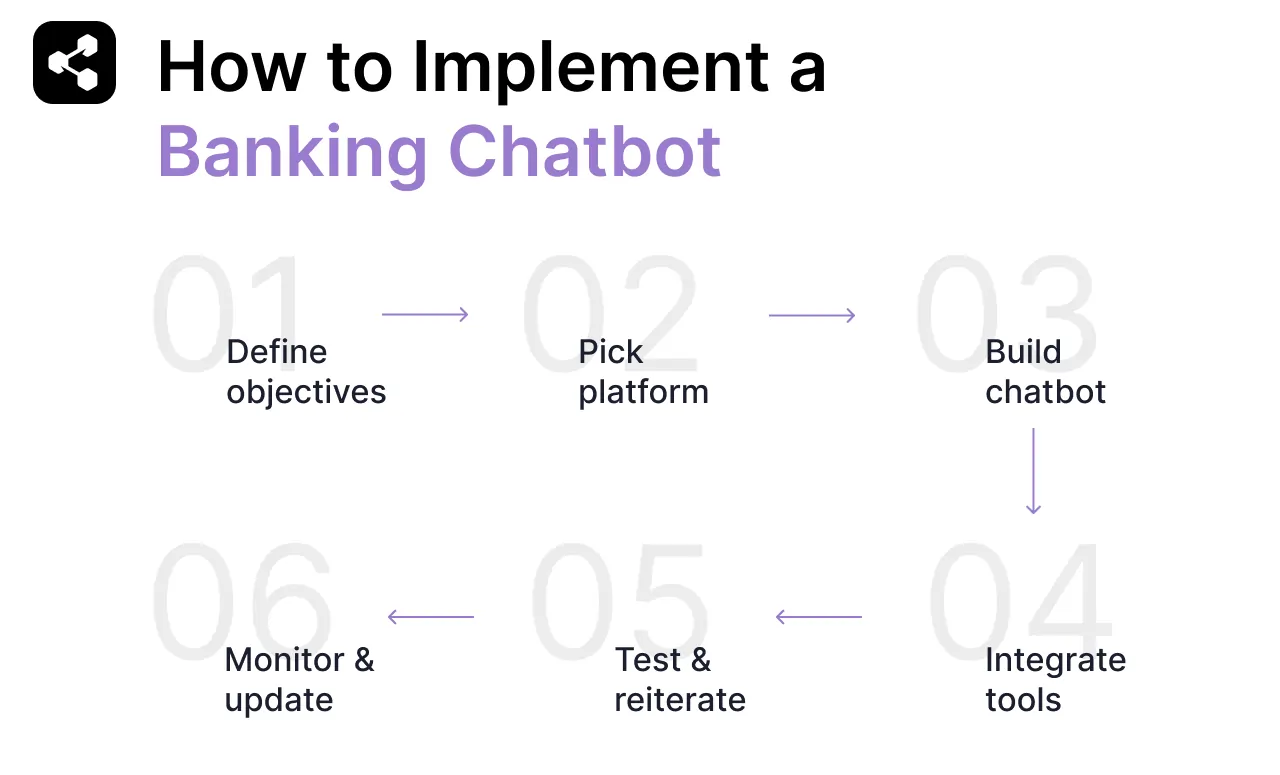

How to Implement a Banking Chatbot

Deploying an AI chatbot in the financial sector can seem complex, but delaying adoption risks falling behind in a competitive industry. In a high-stakes industry like finance, your team will need to create a custom chatbot for your specific services.

To ensure success, it’s essential to tackle the specific needs and challenges of financial services while maximizing the potential of AI.

Here’s how to get started:

1. Define your objectives

Clarify what you want your chatbot to accomplish. Is it answering basic customer queries, assisting with complex fraud detection workflows, or orchestrating end-to-end compliance automation across departments?

Banking chatbots can go beyond handling customer queries – they may assist internal teams with market analysis, regulatory checks, or transaction risk assessments.

Your objectives will determine whether you need a customer-facing bot, an internal workflow assistant, or a multi-functional AI agent.

2. Pick a platform

Selecting a platform tailored to the financial sector is crucial. The best chatbot platforms will allow you to start building for free, so you can test out their tools. Look for:

- Regulatory Compliance: Ensure the platform aligns with financial regulations like PCI DSS, GDPR, or local banking standards.

- Integration Capabilities: It should connect with your core banking systems, fraud detection software, CRMs, and payment gateways.

- Security Features: Advanced encryption, multi-factor authentication, and role-based access are non-negotiable for financial data protection.

- Customizability: Choose a platform that lets you fine-tune the chatbot’s functionality to match your organization’s specific needs.

3. Build your chatbot

Ensure the chatbot is trained on domain-specific data and scenarios, such as:

- Detecting anomalies in transactions for fraud prevention.

- Assisting customers with investment advice or loan applications.

- Automating account management tasks, like balance checks or recurring payment setups.

Integrate knowledge bases for banking products, financial regulations, and market insights to make the chatbot a reliable resource for users and teams alike.

4. Integrate essential tools and systems

In the financial sector, smooth integrations can make or break your chatbot’s effectiveness. Key systems to integrate include:

- Fraud detection platforms: Tools like ThreatMetrix to flag suspicious activity.

- CRMs: Salesforce or HubSpot for managing customer interactions.

- Compliance tools: Automated tracking and reporting for regulatory audits.

- Market data platforms: APIs for real-time stock, currency, or commodity pricing.

These integrations ensure your chatbot delivers accurate, actionable information.

5. Test and reiterate

Financial chatbots operate in high-stakes environments where errors can erode trust. Test rigorously with edge cases, such as:

- Unusual transaction patterns for fraud detection.

- Ambiguous compliance questions.

- Complex multi-step processes like mortgage applications or wealth management recommendations.

Use stress testing to evaluate how the chatbot performs under peak demand, such as tax season or market volatility.

6. Deploy and monitor

Once live, monitor the chatbot’s performance using analytics. Key metrics for financial chatbots include:

- Accuracy of responses to complex queries.

- Fraud detection rates and false positive reductions.

- Customer satisfaction scores and feedback trends.

Set up automated feedback loops for ongoing improvements, ensuring the chatbot evolves as regulations change, customer needs shift, or new financial services are introduced.

Deploy a secure banking chatbot this year

Finance companies are leveraging AI chatbots to automate workflows, detect fraud, and provide personalized financial insights – all while enhancing customer trust and operational efficiency.

Botpress is an enterprise-grade platform for building secure, scalable AI chatbots and agents tailored for finance.

With advanced integrations, developer-first tools, and robust compliance features, you can streamline processes and deliver exceptional service.

Start building today. It’s free.

Or talk to our sales team to get started.

FAQs

1. How do chatbots adapt to new banking regulations across different countries?

Chatbots adapt to new banking regulations across different countries by using modular rule engines and regularly updated compliance logic. As long as the platform supports knowledge updates and API-based data control, compliance teams can make jurisdiction-specific adjustments without redeploying the bot.

2. Do I need an in-house development team to build a banking chatbot?

You do not need an in-house development team to build a banking chatbot if you're using a low-code platform like Botpress, which offers drag-and-drop tools. However, for more advanced integrations (e.g., with core banking systems), having technical resources available is recommended.

3. How much customization is possible when building a chatbot for a niche banking service?

When building a chatbot for a niche banking service, customization is extensive: you can define unique workflows, apply domain-specific natural language models, set custom branding, and connect to proprietary systems via APIs or SDKs. This enables the bot to deliver personalized, regulatory-compliant interactions tailored to a specific banking niche.

4. How do banking chatbots store and handle sensitive user information?

Banking chatbots store and handle sensitive user information using secure data channels (in transit and at rest), role-based access control (RBAC), and detailed audit logs. Leading platforms are SOC 2, ISO 27001, and GDPR compliant, ensuring data privacy and traceability are baked into the infrastructure.

5. Can chatbots handle multiple customer profiles (e.g., business and personal banking) in one session?

Yes, chatbots can handle multiple customer profiles like business and personal banking in one session by segmenting users based on input context or linked CRM data. The bot can then adjust its offerings and decision flows to match the active user profile in real time.

.webp)

.webp)